Nearly 3,000 special districts play a significant role to provide critical and essential services to millions of Texans altogether providing critical infrastructure and essential services, with a heavy focus on water resources and public safety, in all but one of Texas’ 254 counties.

Texas ranks third in the nation for the number of special districts, making the sector of local government, by far, the most common in the state. It’s no surprise that special districts offer nearly the full array of non-education, local public services – including water utilities, emergency services, ports, transit systems, libraries, sewer, recreation, surface water and groundwater management, drainage/flood control, mosquito abatement, crime control and prevention, jails, and hospitals.

These special districts have a Texas-size story to share – especially as two members of the Texas Congressional Delegation prepare to re-introduce legislation to federally define “special district.” Doing so is necessary to not only achieve collective federal priorities but is also favorable state-level policies (primarily protecting local control and revenue stability) in Austin.

The Lone Star State’s special districts story is best written with the official data available – through the U.S. Census Bureau’s studies and surveys of local government, the Texas Comptroller’s Office, and other local data sources. As the team at GovFin, an American Association of Special Districts’ (AASD) Research, Academic, and Data Member, begins to analyze freshly-updated key datapoints, AASD is working with member districts and stakeholders to provide context to the data.

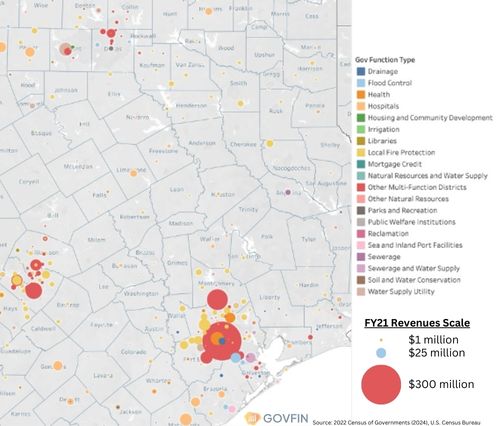

As details emerge from the most recent Census of Governments (2022), we begin to write Texas’ story for a special purpose – and the significance they play in certain regions more than others across the second-largest state by population and size in the nation… especially in the nation’s fifth-largest metropolitan area.

Houston Depends on Special Districts – Especially for Water Resources

Approximately one-third of special districts in Texas provide services in the Greater Houston area (1,010 in the seven-county region – nearly as many special districts as the entire state of Oregon).

The most predominant type of special district in the region, by far, are those that provide multiple functions, as depicted in the GovFin graphic at right – primarily water utilities services (water/wastewater). Known as municipal utility districts (MUDs), these special districts are similar to Colorado’s metropolitan districts where a town, city, or county governing body approves creation of a district to facilitate public investment in infrastructure critical to development.

MUDs are the powerhouse special districts in the Houston Metro Area, most often providing water and wastewater utilities from the communities’ establishment and development. The U.S. Census Bureau classifies most of these districts as “multi-function districts,” which is an overly broad and inconsistent category that gives district data experts a headache. The vast majority of special districts providing services in Fort Bend and Harris Counties fall under this category.

Beyond MUDs, the significance of special districts providing water utilities, conservation/management, and drainage in the region cannot be understated. The Houston Metro depends on special districts to provide these services at a rate far greater than the rest of Texas.

According to Texas Comptroller data for the 2023 tax year, nearly 90 percent of the special districts providing public services in the Houston area provide water resources. That figure is closer to 60 percent for all of Texas’ special districts – including municipal water, conservation, flood control, sewer, and irrigation.

Fire & Emergency Services in Southern, Central, and Eastern Texas

Not to be outdone – the State Association of Fire and Emergency Districts (SAFE-D) estimates more than 8 million Texans rely on emergency services districts for fire protection and ambulance service. The 2022 Census of Governments captured 264 special districts providing local fire protection service.

Emergency services districts (ESDs) are predominantly located along the Interstate 35 corridor from San Antonio through the greater Austin Area, and eastward into the Houston region. In fact, more than half of ESDs provide services in the counties of these three major metro areas: 30 percent are located in the seven-county Houston Metro and another 16 percent are located in the five-county Austin Metro and 9 percent in the nine-county San Antonio Metro.

Texas Special District Services and Property Taxes

While some special districts in Texas can levy sales tax – including hospital districts, some emergency services districts, and the state’s 15 library districts – most special districts are authorized to levy local property taxes or assessments of some kind for the purposes of general revenue, operations, maintenance, and other purposes. Notably, library districts in Texas do not collect property taxes.

A GovFin analysis of financial data from the 2022 Census of Governments, using FY21 reporting, shows that all special districts in Texas provide their services on a 4.4 percent share of all property taxes collected in the state. By comparison, Texas’ 1,200 school districts depend on property taxes 13 times as much as much as special districts.

Special districts’ piece of the statewide property tax pie increases to 10.1 percent when property tax allocations to school districts are removed from the equation for FY21. In 2017, Census figures estimated special districts provided one-fifth of all local non-education government services – a sign that districts can provide robust services on a smaller revenue base with few additional funding sources to pull from.

It is for this reason why relatively small tweaks to property tax policies from the state legislature can be relatively large.

For now, legislation addressing property taxes in Texas – the seventh highest in the nation for local property tax by valuation – is focused on schools. TX SB 4 (Bettencourt) and TX HB 2611 (Raymond) would increase the homestead exemption for purpose of school district assessments from $100,000 to $140,000, with backfill revenue from state coffers to soften the blow. However, bills seeking to limit revenue increases are in waiting, as the debate over how to mitigate local property tax increases reaches Austin.

Now, increasingly more than ever, it is important for Texas’ special districts to have a unified front in their state capitol, and to tell their collective story – to unite, strengthen, and advance the state’s 3,000 special districts.

The Importance of Data-Based Storytelling to Advocacy Efforts

AASD’s synergy with Texas special district stakeholders – and their emerging Texas Special Districts Coalition – offers a new page to write the special districts story and securing a positive place in the minds of Texas policymakers.

AASD is collaborating with partners to create accurate talking points for introducing the Texas special district sector of government, as a whole, to policymakers and identify key trends in revenues and finance. Importantly, this collaboration helps put into perspective special districts’ imbalanced access to programs aimed to support local government services, and it serves as a clear cause for Texas’ special districts to band together for seat at the policy table to prevent unintended – or intended – consequences of policies on special districts’ ability to provide robust public services.

From Texas and beyond, elevating awareness of special districts’ services to their communities at all levels of government (county, regional, state, and federal) is critical. AASD, through the support of members and partners, stands to be a resource to telling this story.

There’s Plenty More Where this Came From

Do you have questions for the AASD Research, Academic, and Data (RAD) Team and the Coalition Development Team on the Texas special districts landscape? Curious about special district statistics and characteristics is other states and at the national level? Let us know. Email contact@americasdistricts.org. We look forward to diving into the data weeds.

This article is made possible thanks to the research contributions of Evan Kersten and GovFin. GovFin provides actionable intelligence from reliably collected data across public sector organizations and federal, state, and local sources. Their goal is to empower those directly impacted by public sector activities to maximize their opportunities through our rich data ecosystem. Learn more about GovFin at www.govfin.io.