Professional Network | Perspectives

Richard Seline | Future Proofing America Collaborative

The past two years have delivered a stark reminder of America’s vulnerability to natural disasters. From the devastating wildfires scorching California to the hurricanes battering the Gulf Coast, extreme weather events are increasing in frequency and intensity, leaving a trail of economic destruction in their wake.

In 2023-24 alone, the U.S. experienced a record-breaking 35+ separate billion-dollar weather and climate disasters, according to NOAA, with total costs soaring past $165 billion. This alarming trend underscores the urgent need for a national shift towards pre-disaster mitigation and resilience investment across all sectors of our built environment. Initial estimates for rebuilding Los Angeles now exceed $200 billion.

The cost of inaction is simply too high. For many special districts that operate on lean budgets, the relative burden to recover from an unmitigated disaster can be near existential.

Costs and Benefits of Mitigation

Beyond the immediate human toll, natural disasters inflict lasting damage on our economy. The National Institute of Building Sciences (NIBS) estimates that every $1 invested in mitigation saves $6 in future disaster costs. Yet, we continue to prioritize reactive measures, pouring billions into recovery efforts while underinvesting in preventive strategies that would ultimately save money, protect lives, and strengthen our communities and economies.

This reactive approach has far-reaching consequences. Businesses face crippling disruptions, supply chains buckle, and critical infrastructure like hospitals and schools crumble under the strain. But the real danger lies in the cumulative impact of repeated disasters. Industries that depend on reliable infrastructure and predictable operating conditions, such as hospitality-tourism, agriculture, and manufacturing, are particularly vulnerable. Repeated disruptions erode productivity, discourage investment, and ultimately undermine economic competitiveness.

Communities, especially those with limited resources, face a devastating cycle of damage and rebuilding. Persistent disasters drain local budgets, divert funds from essential services like education and healthcare, and hinder long-term economic development. This creates a downward spiral, where communities become increasingly vulnerable and less able to recover with each subsequent event.

A 2023 study by the Urban Institute highlights this challenge, stating, “Repeated disasters can overwhelm local governments’ fiscal capacity, leading to service cuts, tax increases, and delayed recovery.”

The public sector also faces immense challenges. Repeatedly rebuilding the same infrastructure strains federal and state budgets, diverting resources from critical investments in education, healthcare, and social programs. This can lead to a deterioration of public services, increased debt burdens, and a decline in the overall quality of life. The Congressional Budget Office, in its 2024 Long-Term Budget Outlook, projects that “the federal government’s costs for disaster relief will increase significantly over the next 30 years…”

A National Pivot in Disaster Risk Exposure for Communities: Why This, Why Now?

We have identified six (6) drivers for a pivot in how state and local governments are directly impacted by the overwhelming intensification of storms and hurricanes, the massive sweep of wildfires, the cascading impacts on individuals and families as well as the economic engines of our communities:

- Failing and Neglected Residential, Commercial, Public Assets and Infrastructure

- Rising Insurance Cost, Limited Capacity, Persistently High Market Gaps

- Mortgage Repricing from Defaults

- Asset Devaluation by Public and Private Sector Financial Institutions

- Overwhelmed Elected-Appointed Officials and Taxpayers from the ”Disaster Tax”

- Negative Impacts on Local Economic Competitiveness, Industries Recruitment, Workforce Stability

Combined, these challenges are increasingly contributing to the daily onslaught of articles and media reports – furthering fear and uncertainty about personal financial choices. The number of uninsured – where premiums are out of reach or policies are not available – continues to rise. Failure to have insurance leads to the inability to obtain a mortgage or the worse-case of accelerating defaults. Public buildings, facilities, infrastructure – already strained – require more than just the basic capital improvements.

So, like watching a dog chasing its tail, the spiral of what we define as the “Disaster Tax” has begun to effect asset values, tax receipts, and the expected difficulties for obtaining financing and investment including resources for private sector developers of affordable housing for instance.

The impact on the real estate market is equally profound. As Larry Fink, CEO of BlackRock, recently stated, “Climate risk is investment risk.” Properties in hazard-prone areas are becoming increasingly uninsurable, jeopardizing mortgages and depressing property values.

As thousands of special district leaders know all too well, erosion of property values further weakens the tax base, making it even more difficult for communities to fund recovery and rebuild.

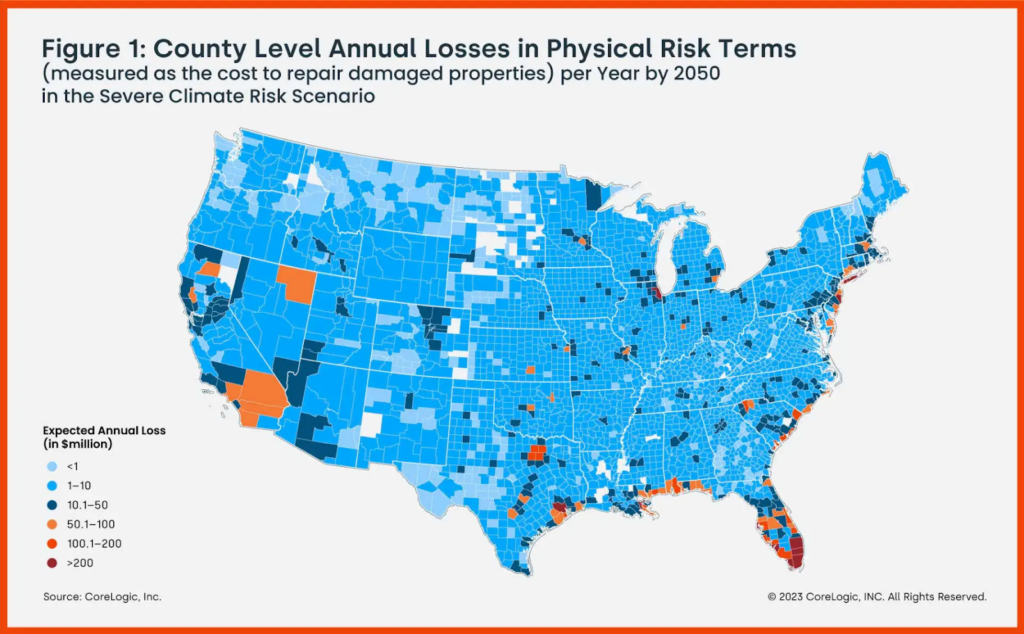

According to a 2023 report by CoreLogic, “Rising insurance premiums and deductibles are making homeownership unaffordable for many Americans, particularly in high-risk areas.” This trend is already leading to increased mortgage defaults and foreclosures, with CoreLogic forecasting a potential 20% increase in seriously delinquent mortgages in high-risk coastal areas by 2025.

Adding to this, insurance gaps are widening. “The insurance industry is struggling to keep pace with the escalating costs of climate-related disasters,” says Chuck Chamness, CEO of the National Association of Mutual Insurance Companies. “This is leading to higher premiums, reduced coverage, and even insurer withdrawals from high-risk markets.” This leaves homeowners and businesses increasingly exposed to financial ruin in the event of a disaster.

Forecasting the Impacts: A Looming Crisis for Urban and Rural Communities

- Flood: First Street Foundation projects annual flood losses to increase by 26.4% by 2052, reaching $43.1 billion. Low-to-moderate income (LMI) neighborhoods are disproportionately affected, often lacking the resources for flood protection and facing higher risks of displacement.

- Wind: A 2023 report by Verisk Analytics estimates that insured losses from hurricane wind damage could exceed $100 billion in a single year by 2050. LMI communities often reside in older, less resilient housing stock, making them more susceptible to wind damage and economic hardship.

- Wildfire: According to a 2022 study by the U.S. Forest Service, wildfire risk is projected to increase significantly in the coming decades, with annual wildfire-related losses potentially reaching $20 billion by 2050. LMI communities located near wildland-urban interfaces are particularly vulnerable to wildfire damage and displacement.

- Other Perils: Extreme heat, drought, and severe storms are also projected to increase in frequency and intensity, further straining resources and exacerbating existing inequalities. LMI households often have limited access to cooling centers, reliable transportation, and healthcare, making them more vulnerable to the health and economic impacts of these events.

Special Districts Are Vital Partners in the Nation’s Transformation of Resilience and Investment

A certain devolution of the federal role in preparedness, recovery, rebuilding is underway. The Stafford Act – the underpinning of FEMA and a Whole of Government approach to disasters will also surely be modernized and adjusted to new realities. Along the way, the National Flood Insurance Program – long-threatened by constant Congressional appropriation requests – will shift to an alternative form of coverage to be determined by the overall national debate about risk – who “owns” it and who pays for it?

Yet, the federal much less state and local government cannot cover the significant cost for both immediate response-recovery while also funding long-term mitigation levels required for achieving a higher value for resilience. Many communities already have the structures in place for planning, development, management, and performance operations-maintenance – simply the frameworks and necessary governance have received prior benefit of citizen, taxpayer, community, business, and other advocate support.

And where these structures do not exist, the confidence from legislatures, county executives, mayors and councils in the formation of tax-exempt financing and special purpose project delivery can be replicated for a more comprehensive and integrated investment in resilience. Special Districts serve these purposes well.

Additionally, the viability for engaging private and philanthropic sectors in strategic funding, financing, investing, and program delivery with Special Districts has been proven among housing and community development scenarios where operational and fiscal gaps exist.

For these reasons – and the necessary innovation demanded for addressing the current inefficiencies, uneconomical approach to the Nation’s disaster risks – we believe the formation of our Resilience Utility and Smart Watershed Districts leveraging our Community Resilience Bonds can best be achieved by collaborating with special district leadership.

Since, the mid-1980s, the Nation has suffered over $4.4 trillion in losses. To reverse this trajectory, we need a significant pivot. Investing in pre-disaster mitigation must become a national priority. The time for incremental change is over. We need bold action to future-proof America. Investing in pre-disaster mitigation is not just an economic imperative; it’s a moral obligation to protect our citizens, our communities, and our future.

Special Districts Getting Engaged in Resiliency

Special district leaders are invited to join us in this important discussion and implementation strategy during our upcoming session at the American Association of Special Districts’ Southern Special Districts Governance Summit, where we will engage participants in a facilitated “whiteboard” process.

Register here for the Southern Special Districts Governance Summit.

We look forward to presenting our draft public-private-philanthropic financing model, seeking to attract the enlightened self-interests of insurance-reinsurance, real estate and mortgage banking, philanthropic and impact investment.

Richard Seline is the Executive Director of Future Proofing America Collaborative and Managing Partner/CEO of ROAR Partners. The Future Proofing America Collaborative is an AASD Founding Professional Network Member. Learn more at https://www.roarpartners.co/